Scheme features of Kotak Multicap Fund:-

Name of the Scheme:- Kotak Multicap Fund

Category of Scheme:- Multicap

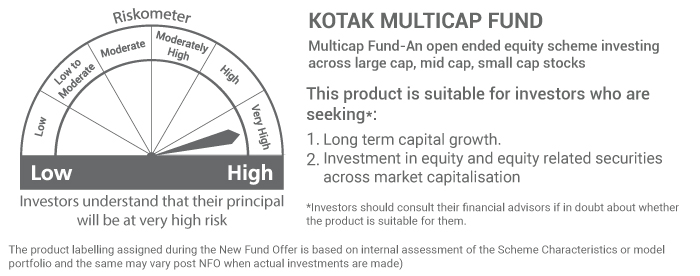

Type of scheme:- Multicap Fund - An open-ended equity scheme investing across large-cap, mid-cap and small-cap stocks.

Benchmark Name:- Nifty 500 Multicap 50:25:25 Total Returns Index

Investment Objective:- The investment objective of the scheme is to generate long-term capital appreciation from a portfolio of equity and equity-related securities across market capitalisation. However, there is no assurance that the objective of the scheme will be realized.

Fund Manager(s):- Harsha Upadhyaya and Devender Singhal for Equity Abhishek Bisen for Debt Arjun Khanna for Overseas Investments

Minimum Application Amount:- Initial Purchase (Non-SIP) - Rs. 5,000/-and in multiples of Rs. 1 for purchases, and Rs. 0.01 for switches. Additional Purchase (Non-SIP) - Rs. 1,000/-and in multiples of Rs. 1 for purchases, and Rs. 0.01 for switches. SIP Purchase - Rs. 500/- (Subject to a minimum of 10 SIP instalments of Rs. 500/- each)

Available Plans/Options:- A) Regular Plan B) Direct Plan Growth and Income Distribution cum capital withdrawal (IDCW) (Pay-out and Reinvestment)

Entry Load:- Nil

Exit Load:- For redemption/switch out of up to 10% of the initial investment amount (limit) purchased or switched in within 1 year from the date of allotment: Nil.

• If units redeemed or switched out are in excess of the limit within 1 year from the date of allotment: 1%

• If units are redeemed or switched out on or after 1 year from the date of allotment: NIL

Any exit load charged (net off Goods and Services Tax, if any) shall be credited back to the Scheme.

To get scheme related more information and application form: click here

Riskometer

Mutual fund investments are subject to market risks, read all scheme related documents carefully.